NEGATIVE GEARING & RESIDENTIAL PROPERTY INVESTMENT

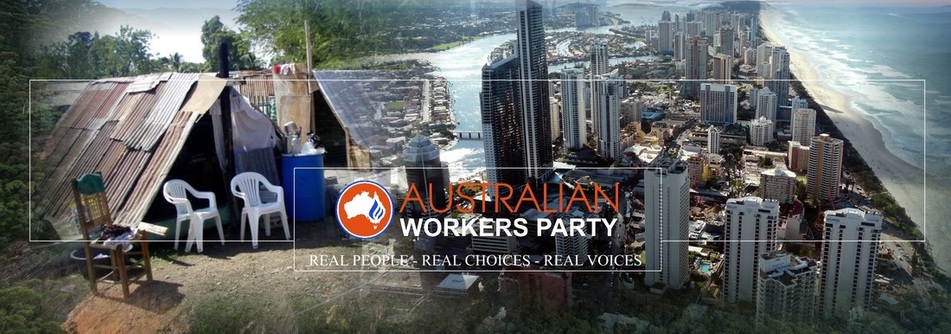

Negative gearing and property investment has been used as a wealth generator and vehicle for tax minimisation for some of the wealthiest in our communities. Rapid capital gains in property have pushed many investors to purchase multiple properties and leave them sitting vacant. In 2014, more than 82,000 investment properties in Melbourne alone, sat vacant. The combined vacant properties in Sydney and Melbourne outnumber Australia’s total homeless population by 2:1. Vacant investment properties inflate property and rental prices across the board, affecting every single Australian.

We do not believe that people should be prevented from investing in property – only that they should be prevented from investing in residential property and leaving it sit vacant – pushing up cost of living, feeding poverty rates, homelessness and financial stress for others, while focussing on personal wealth creation through aggressive tax minimisation – reducing their contribution to society as a whole.

We believe that those who purchase property and deliberately leave it vacant, should be affected by way of having their tax minimisation strategies reduced on a relative pro rata basis. So called ‘mum and dad investors’ do not leave their investment properties vacant as they simply cannot afford to. A vacancy levy, relative to the amount of tax minimisation claimed, directly affects only the wealthiest investors and discourages investment strategies that negatively impact on the rest of us.

FOR CURRENT INVESTORS

Residential investment properties, used for the purposes of negative gearing, will be subject to a vacancy levy – payable at a rate relative to the claimed deductions for the same financial year period. This levy, payable by owners of any residential property remaining vacant (excluding those vacant for a reasonable time period for the purposes of renovation), shall be applied as per the following.

FOR ALL FUTURE INVESTORS

OWNERSHIP

We do not believe that people should be prevented from investing in property – only that they should be prevented from investing in residential property and leaving it sit vacant – pushing up cost of living, feeding poverty rates, homelessness and financial stress for others, while focussing on personal wealth creation through aggressive tax minimisation – reducing their contribution to society as a whole.

We believe that those who purchase property and deliberately leave it vacant, should be affected by way of having their tax minimisation strategies reduced on a relative pro rata basis. So called ‘mum and dad investors’ do not leave their investment properties vacant as they simply cannot afford to. A vacancy levy, relative to the amount of tax minimisation claimed, directly affects only the wealthiest investors and discourages investment strategies that negatively impact on the rest of us.

FOR CURRENT INVESTORS

Residential investment properties, used for the purposes of negative gearing, will be subject to a vacancy levy – payable at a rate relative to the claimed deductions for the same financial year period. This levy, payable by owners of any residential property remaining vacant (excluding those vacant for a reasonable time period for the purposes of renovation), shall be applied as per the following.

- Any residential property remaining vacant for a period of no less than 60 days, but not exceeding 180 days, shall be subject to a levy equal to 50% of all deductions claimed for that property during that financial year, or $2500, whichever is the greater

- Any residential property remaining vacant for a period greater than 180 days, shall be subject to a vacancy levy equal to 100% of all deductions claimed for that property during that financial year, or $5,000, whichever is the greater

- All levies shall be deducted, by the Australian Taxation Office, prior to any tax refund being issued to the owner of the relevant property.

- Any monies that may be outstanding after the completion of the processing of any tax return, shall be due and payable to the Australian Taxation Office within 90 days.

- No deductions will be claimable on any residential investment property where any prior vacancy levies have not been paid by the due date.

- A ‘reasonable time period for renovations’ as referred to above, shall be a time period not exceeding three months in any five year period (necessary renovations as a result of damage caused by natural disaster are exempt from this provision, except where it is deemed that delays have been deliberate in nature. Such deceptive behaviour, may, if deemed appropriate, be referred to the relevant authorities).

- Any owner of a residential investment property, who incurs a vacancy levy on 3 or more occasions, for any one property, shall, by that action, relinquish any right to claim a Capital Loss or Capital Gains Tax Discount, at any future point, for that same property.

- Rules for ‘current investors’ shall remain in force for a period of five years. Thereafter, such investors will be subject to the rules currently applicable to ‘future investors’.

FOR ALL FUTURE INVESTORS

- Negative gearing deductions may only be claimed on tenanted residential properties.

- Residential Investments must maintain a vacancy rate lower than 10% per annum in order to be considered as a tenanted investment.

- Exemptions, in full or in part, may apply in the event of damage due to natural disaster, provided such damage requires medium to large scale repairs.

- No other exemptions will apply.

- Properties that remain untenanted for more than 36 days during any year, forfeit any negative gearing claims against that property for that year.

- Any property that is subject to forfeiture of claims on three (3) or more occasions, will relinquish any right to claim a Capital Loss or Capital Gains Discount, at any future point, for that same property.

OWNERSHIP

- No financial benefit shall be claimable through the Australian Taxation Office, for the disposal of any residential property, where that sale is to any person deemed to be a ‘family member’.

- A ‘family member’ as referred to above, is any person defined as a ‘family member’ according to any definition held by the Australian Governments Departments of Taxation, Communities or Immigration and Border Protection.

- No person shall be permitted to purchase residential property, for the purposes of investment, who is not a citizen of Australia.

- Any residential investment properties, currently held by persons who are not citizens of Australia, or held by commercial entities owned in full or in part, by any person not a citizen of Australia, shall dispose of the property within 12 months.

- All funds raised by the vacancy levy will be directed into the development of emergency and long term affordable housing projects and regional area community development projects.